HISTORY

What is the Permanent Fund?

Learn more about how Alaskans successfully worked together to convert the state's non-renewable resources into the state's largest, renewable financial resource for the benefit of generations to come.

Establishing the Fund

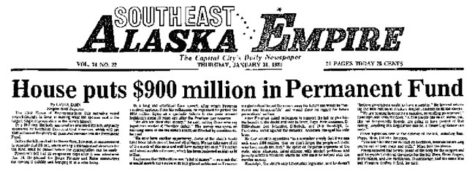

Ten years after Alaska achieved statehood, oil was discovered on the coast of Alaska on state land. It was a huge find and when the state held the 1969 North Slope oil and gas lease sale a year later, it brought in $900 million in revenue. While there was a significant amount of debate at the time as to whether some or all of the money from the lease sale should be saved, ultimately the proceeds were used to support infrastructure and social programs throughout the young state.

In 1974, as construction of the Trans Alaska pipeline began, Alaskans were looking towards the future and deliberating on how to best utilize the anticipated mineral royalties. Many of the state’s decision makers supported putting a portion of the expected revenues into a "permanent fund," where they would be out of reach of day-to-day government spending and could generate income into perpetuity.

Alaska’s Constitution does not allow for dedicated funds, so to direct these oil revenues into a permanent fund, the Constitution had to be amended. Placing the founding language for the fund in the Constitution had the added benefit of helping protect it from being spent by the Legislature without a vote of the people. A Constitutional Amendment requires a majority vote of the people of Alaska and one establishing the Permanent Fund was approved 75,588 to 38,518 in 1976.

Alaska Constitution Article IX, Section 15

Section 15. Alaska Permanent Fund.

At least twenty-five percent of all mineral lease rentals, royalties, royalty sale proceeds, federal mineral revenue sharing payments and bonuses received by the State shall be placed in a permanent fund, the principal of which shall be used only for those income-producing investments specifically designated by law as eligible for permanent fund investments. All income from the permanent fund shall be deposited in the general fund unless otherwise provided by law.

Establishment of APFC

On February 28, 1977, the Permanent Fund received its first deposit of dedicated oil revenues totaling $734,000. Investments consisted almost entirely of bonds, while the Legislature had a four-year public discussion regarding whether the Permanent Fund should be managed as an investment fund or as an economic development bank.

Governor Jay Hammond signed a bill in 1980 creating the Alaska Permanent Fund Corporation (APFC) for the purpose of managing investments. One of the goals when creating the Corporation was to protect the fund from political influence through the establishment of a six-member Board of Trustees, who serve as fiduciaries.

APFC’s first Board of Trustees was established with Elmer Rasmuson as Chair, Thomas Williams as Vice-Chair, Wilson Condon, Peter McDowell, George Rogers and Robert Ward as members.

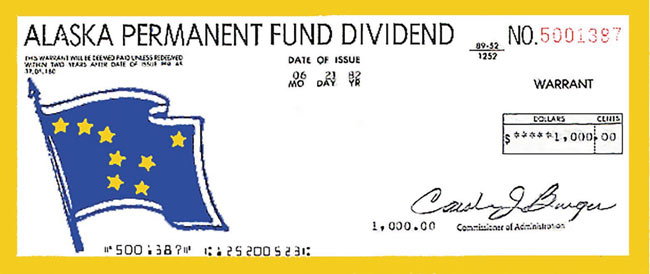

Also in 1980, the Legislature approved the Permanent Fund Dividend program. The first dividend check of $1,000 was distributed two years later.

APFC History

In 1990, APFC celebrated its 10th anniversary with a video about the Fund and a discussion with its early leaders.

In 2010, APFC celebrated its 30th anniversary and created this video highlighting the history of the Fund and the Corporation.

Timeline of the Fund and APFC

AN Alaskan's Guide to the Fund

Alaska is more reliant than ever on the Permanent Fund. The Alaskan's Guide to the Permanent Fund explains the basics on the Alaska Permanent Fund, its history, how APFC manages and invests these assets, and its essential role in Alaska's future.

1980 Trustee Paper 1

Public Investment in Alaska, Essays from the Early 1980s

1989 Trustee Paper 3

The Role of the Permanent Fund in Alaska's Fiscal and Economic Future

1997 Trustee Paper 5

The Early History of the Alaska Permanent Fund

1999 Trustee Paper 6

The Role of the Permanent Fund in Alaska's Future: The Principles and Interests Project

In the classroom

We hope that the resources provided here and throughout our website will be useful in helping you teach about the Alaska Permanent Fund and the Corporation that manages and invests these assets for all generations of Alaskans.

This section includes a presentation and three quizzes for secondary level students. We recommend that teachers instruct students to use the web site to research the answers. An Alaskan's Guide to the Permanent Fund is also a valuable resource.

Teachers may wish to download the PowerPoint or quizzes to use their classes. The presentation contains a notes section to help teachers deliver the concepts to their students.

1982 |

1982 |

anniversary. FY16 is another volatile year, with continued global market corrections and declines in oil prices. However, APFC and the Fund are able to weather the storms with a diversified asset allocation, allowing significant losses in stocks to be offset set by gains in other asset classes. Oil prices eventually enter a period of relative stability, and the bond market outperforms expectations. The Fund ends FY16 with a value of just under $53 billion.

anniversary. FY16 is another volatile year, with continued global market corrections and declines in oil prices. However, APFC and the Fund are able to weather the storms with a diversified asset allocation, allowing significant losses in stocks to be offset set by gains in other asset classes. Oil prices eventually enter a period of relative stability, and the bond market outperforms expectations. The Fund ends FY16 with a value of just under $53 billion.